Using Value-Ad’s Bestpair™, the Singapore division of one of the world’s largest property and casualty insurance companies recently increased their Outbound Telemarketing sales by an average of 79.9% over 21 months.

Big Insurance Company* serves clients of all sizes with traditional and specialty insurance products. Their Singapore division was looking to increase personal insurance sales to credit card holder leads supplied by a large bank, using their current outbound call centre agents, and existing technology.

Key Challenges for Big Insurance Company’s Outbound Call Centre

The challenges Big Insurance Company* were facing include:

- Competitiveness of Singapore’s insurance market where many companies compete for the same clients and revenue

- Stagnation in the growth of sales

- Prospect fatigue i.e. leads have been contacted many times by many companies.

Big Insurance Company’s Past Process

Sales leads provided to Big Insurance Company* by one of Singapore’s biggest banks were allocated randomly to their Outbound call Centre agents.

Value-Ad’s Bestpair™ Solution

Value-Ad has partnered with Big Insurance Company* on a shared risk/reward basis, and Bestpair™ was applied to Big Insurance Company’s Outbound Call Centre process in order to overcome the above challenges in the following way:

- Big Insurance Company* using the same Outbound Call Centre staff, data, technology and processes

- Value-Ad analysing each of the agents’ historical success and failures (excluding PII data) to determine the type of leads each agent is most successful in selling to

- The Bank sending new leads (excluding PII data) to Value-Ad to be matched to Big Insurance Company*salespeople

- Value-Ad assigning new leads to the salespeople according to each salesperson’s model, as well as the guidelines (if any provided) by Big Insurance Company*

- Value-Ad sending the list of leads to salesperson allocations to Big Insurance Company* to be distributed via the usual process

- Big Insurance Company* and Value-Ad measuring the effectiveness of the models on a monthly basis (please refer to Figure 1 and Table 1 below)

- Value-Ad applying model updates to the next batch of leads assigned.

Measuring Effectiveness of Bestpair™

It is critical to be able to measure and verify the results achieved due to Bestpair™. This is to ensure that Bestpair™ is actually making a difference, and also that the results achieved are not due to other factors such as the training of outbound staff, management or new technology.

To be able to do this, leads are split into control and matched groups. In the control group, leads are allocated as before i.e. randomly, to the outbound call centre agents, while the matched group leads are assigned using the Bestpair™ method. There is usually a 30% control to 70% matched split.

To ensure that control and matched leads are treated the same, the matched and control leads are supplied to the sales team intermingled. Only Big Insurance Company’s senior management and Value-Ad know which leads were matched and which were controls.

Results

Big Insurance Company’s lift rate increased by an average of 79.9% over 21 months following the application of Bestpair™. This great result is despite the call centre being temporarily shut down due to the pandemic.

Key to this success has been:

- Big Insurance Company* having historical data of success and failures of past sales activity in order to build the models

- The amount of non PII data consistently available and supplied on the leads

- Excess leads provided to Value-Ad to optimize choice further (preferable, but not a requirement)

- Freedom for Value-Ad to choose the salesperson to assign

- The call centre able to assign to salesperson as per recommended match

Results returned to Value-Ad on a regular basis to allow models to be rebuilt.

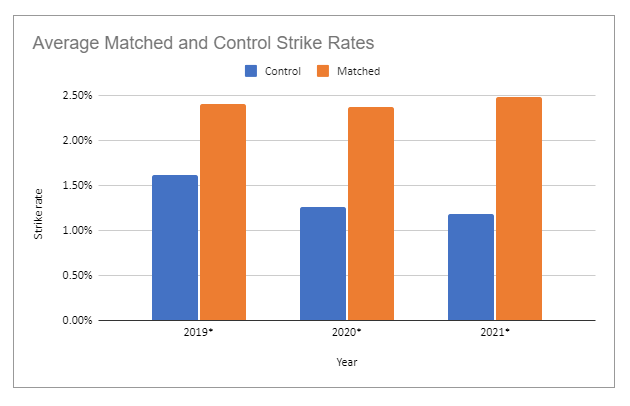

Figure 1: Average strikes rates of matched and control leads where matched leads show a significantly higher average strike rate. (2019* includes months July to December 2020* excludes the four-month shutdown period due to COVID-19, and 2021* includes January to March)

Average lift of strike rates

| 2019* | 2020* | 2021* | Overall | |

|---|---|---|---|---|

| Average | 49% | 88.1% | 110.2% | 79.9% |

Table 1: The rate of increased success that matched leads have in comparison to the controlled leads using the average strike rates of the matched and control leads shown in Figure 1. (2019* includes months July to December 2020* excludes the four-month shutdown period due to COVID-19, and 2021* includes January to March)

As can be seen in Table 1, the results have continued to improve over the years. This is due to a few factors:

- The team size has increased – the Value-Ad Bestpair™ engine works better with bigger teams

- More training data –

- We started the project with 6 months of training data, now we have years of experienc

- Staff retention is higher, therefore more data per salesperson

- Value-Ad’s algorithms constantly improve, and new models are created on a monthly basis for each salesperson.

Conclusion

Using Value-Ad’s Bestpair™, Big Insurance Company* increased the sales of their Outbound Call Centre for credit card focused personal insurance sales by an average of 79.9% over 21 months, the majority of which was during the Covid-19 pandemic. This involved using existing salespeople and technology, and with minimal disruption to legacy processes. Results have been verified by comparing Bestpair™ results with control results, which show Bestpair™ increases the likelihood of a sale from each valuable interaction with a potential customer.

*Due to non-disclosure agreements and for the sake of this study the Insurance Company referred to in this case study shall be referred to as The Big Insurance Company.